What is Climate Cash™?

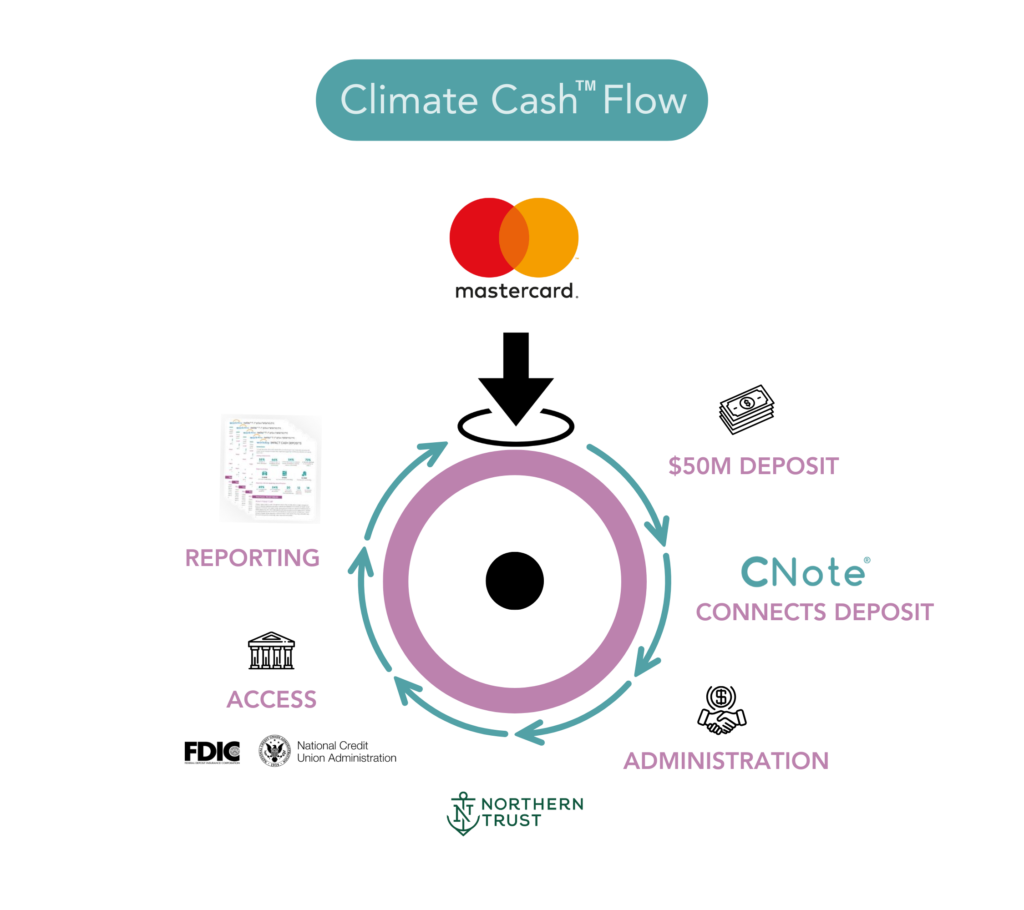

Climate Cash™ empowers corporations and foundations to align their cash management strategies with climate action. By allocating deposits into a network of mission-driven banks and credit unions, Climate Cash™ directly supports initiatives combating climate change—all through a seamless, single-interface platform for monitoring, administration, and reporting.

Every deposit is safeguarded by 100% FDIC or NCUA insurance coverage, offering competitive interest rates and flexible terms ranging from overnight to 12+ months. Additionally, CNote’s impact reporting provides data on the climate-positive activities funded by your deposits, ensuring transparency and measurable results for your financial and environmental goals.

Direct your cash towards a greener future.

100% FDIC and NCUA insured

Designed to be 100% insured via FDIC and NCUA programs, providing positive social and environmental impact with the peace of mind that deposits are backed by the full faith and credit of the United States government

Flexible liquidity

Funds are available on demand, subject to potential early withdrawal penalties assessed by our community partners.

Scalable

Built for scale. Whether you’re deploying $5 million or $50 million we get your capital into communities that need it most.

Impact

CNote only partners with mission-driven financial institutions who have proven impact. Our team reports regularly on the change Climate Cash™ holders are achieving.

Ease of use

Access multiple mission-driven depository institutions with a single account, all online.

Sustainability Alignment

All deposits are deployed into vetted mission-driven financial institutions to support climate change initiatives.

The Problem

Corporations, foundations, and investors of all sizes are increasingly seeking to decrease their carbon emissions through a variety of investment strategies and approaches.

Banking relationships were rarely seen as a way to reduce carbon, but reserved as a point of conversation, divestment or influence around climate.

Climate Cash™ is a deposit solution – enabling these organizations to enjoy 100% FDIC / NCUA insurance, competitive interest rates and contribute to carbon-reduction lending activities.

What Sets Climate Cash™ Apart?

Other sustainable deposit offerings that support a range of decarbonization projects may be part of portfolios that do not strictly exclude fossil fuel investments.

Climate Cash™ investments are directed solely to vetted, mission-driven financial institutions with green lending initiatives, prioritizing the under-resourced communities disproportionately affected by climate change.

Additionally, CNote’s transparent and detailed impact reporting provides Climate Cash™ investors with clear, tangible insights into the effects of their investments. Our clients can see how their deposit strategy aligns with genuine sustainability and community development goals.

Climate Cash™:

Combating Climate Change

Deposits into Climate Cash™ go to a nationwide network of mission-driven banks and credit unions combating climate change with vital green lending initiatives. Your money would go into organizations like:

- Locus Bank, a Fossil-Free Certified CDFI Bank in Virginia. Locus Bank finances clean energy projects such as community solar for neighborhoods and solar-powered small businesses. These projects increase access to clean energy in under-resourced communities while reducing their carbon footprint.

- Clean Energy Credit Union, a Fossil-Free Certified, Women-led, low-income designated credit union in Colorado. Their focus is making clean energy affordable for individuals across the country, which they support through special-purpose credit programs for low-income and borrowers of color. To date, Clean Energy Credit Union has financed over 10,000 clean energy loans and helped offset nearly 700,000 tons of carbon dioxide equivalent.

More than 350 CDFI, credit union & MDI lenders offer green lending products and have originated more than $2.68 Billion in green loans to date.1

The Opportunity

The effects of climate change disproportionately affect under-resourced communities, including low- to moderate-income groups and People of Color communities. Mission-driven banks and credit unions are on the front lines of financial inclusion, as well as equitably increasing access to green innovation, climate-resilient infrastructure, and clean energy upgrades for these groups where other lenders are absent. This support includes providing loans to finance vital climate projects like solar panels, electric vehicle financing, and natural disaster recovery efforts.

These mission-driven banks and credit unions are facing a shortage of deposits, which hampers their ability to finance sustainability and green climate lending initiatives.

Mission-driven lenders need deposits to bolster their green climate lending initiatives. With CNote, corporations, foundations, and other impact investors can answer that need and address sustainability and climate change efforts with 100% full FDIC / NCUA insurance.

Illustrative Climate Cash™ Beneficiaries.

Where your cash makes a difference.

When it comes to our shared climate reality, Hope Credit Union’s members are familiar with the ever-expanding narrative. After all, they’re living it. Across the Deep South, summers are getting hotter, power outages are becoming more common, and electric vehicles (EV) are being plugged into more and more homes. Members, however, aren’t just experiencing these […]

Like the majority of people, Nicole Burford sometimes feels weighed down by the challenges presented by climate change. But as someone who’s long been passionate about environmental protection and sustainability, Nicole has found a way to keep her chin up. “When we think about what we can control as an individual,” she said, “we can […]

Over the span of 48 hours in mid-July 2023, most of Vermont was battered with record amounts of rainfall, resulting in catastrophic flash flooding. As the state’s rivers swelled, homes were submerged, roads and bridges were washed out, and, tragically, at least two lives were lost. The 500-year flooding event devastated communities across The Green […]

Partners

By working with some of the country’s most inspiring and dedicated leaders, Climate Cash™ drives capital and new opportunities into the hands of underserved communities across the United States. CNote partners are committed to co-creating the product alongside the community we aim to serve.