-

Meet Dr. Nola Veazie, the Entrepreneuring Veteran Who’s Growing Her Business around Mental Health and Addiction

Nola Veazie grew up in Panama with the belief that she could do anything she set her mind to. Nola’s mother, who raised her children on her own, encouraged all of her children to dream big; however, when Nola was 16, she realized that the opportunities she wanted for herself didn’t exist in her home…

-

Change Makers Interview: Liza Fleming-Ives

Liza Fleming-Ives may be new to her role as executive director at the Genesis Fund, but she’s not new to the world of community development finance. Instead, Liza has over 20 years of community development experience, 15 of which have been with The Genesis Fund, a Maine-based Community Development Financial Institution (CDFI). Since 1992, the…

-

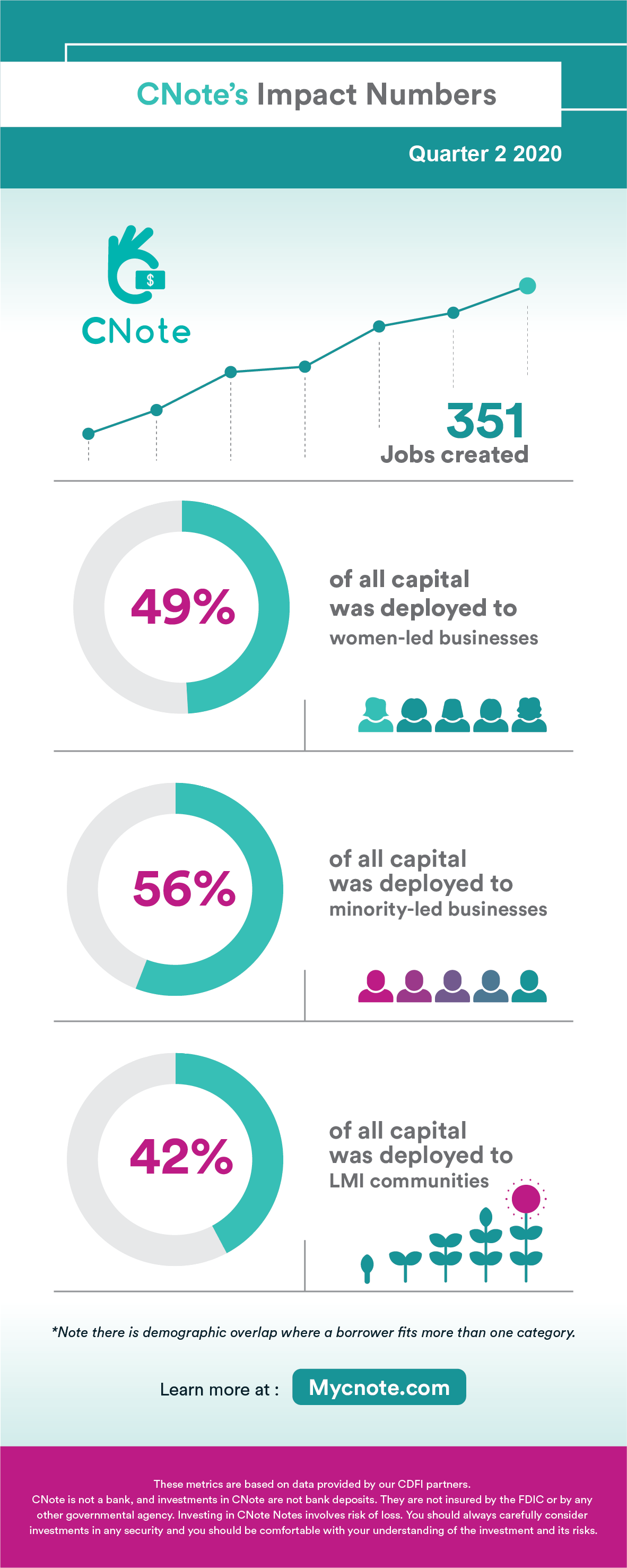

CNote Quarterly Impact Report Q2 2020

Download and view CNote’s Q2 2020 Impact Report We’re excited to announce CNote investors helped create/maintain over 350 jobs in Q2 with a record percentage of dollars flowing to female borrowers! In this report you’ll see: An update from the CNote CEO Details on our quarterly impact Updates on new partners and products A recent…

-

CDFIs: America’s First Responders to Economic Crisis

CDFIs: America’s First Responders to Economic Crisis Community development financial institutions (CDFIs) have consistently operated on the front lines of economic disasters such as 9/11, Hurricane Katrina, Superstorm Sandy, Hurricane Harvey, and the 2008 financial crisis, providing economic relief to American communities when they need it most. As “first financial responders” CDFIs have demonstrated their…

-

The Impact Investment Case For Cash- Featuring San Francisco Foundation

CNote is happy to release our Impact Investment Case For Cash Case Study, which discusses how the San Francisco Foundation (SFF) partnered with CNote to put pre-deployment program-related investment (PRI) dollars to good use. SFF, which is committed to improving life in the Bay Area through its Bay Area Community Impact Fund, realized in 2018…

-

How a PPP Loan From a Low-Income Designated Credit Union Gave This Bay Area Nonprofit The Promise of a Brighter Tomorrow

Barbara McCullough knows a thing or two about nonprofit management. She’s been the CEO at Brighter Beginnings, a nonprofit created in 1984 to respond to the needs of families in resource-poor neighborhoods across Contra Costa and Alameda Counties, for nearly 24 years. With that level of experience comes the understanding that government funding is anything…

-

Latino Community Credit Union Case Study

CNote is proud to share a new case study: The Case for Reaching More Impact Investors which explores how the Latino Community Credit Union (LCCU) was able to increase its deposit base by partnering with CNote. The case study highlights how CNote works with low-income designated credit unions and CDFI banks to grow their deposit…

-

Why CDFIs Often Create Better Lending Outcomes for Small Businesses

Small businesses that need financing often find themselves at a crossroads: apply for a traditional bank loan that’s difficult to get but has lower-interest rates or an online loan that’s quickly approved but can end up being inordinately more expensive in the long run. But some business owners don’t realize that there’s an additional option:…

Blog

Where finance meets impact.