In today’s economic climate, uncertainty is a given. Interest rates are fluctuating, markets are shifting, and corporate finance teams are being asked to do more with less—while still preserving capital, ensuring liquidity, and managing risk.

In times like these, the way companies manage their cash matters more than ever.

Many corporations are reevaluating their treasury strategies (source: WSJ). And one area gaining more attention is where excess cash is deposited—and whether it’s truly working in the company’s best interest.

A Stable Opportunity in an Uncertain Environment

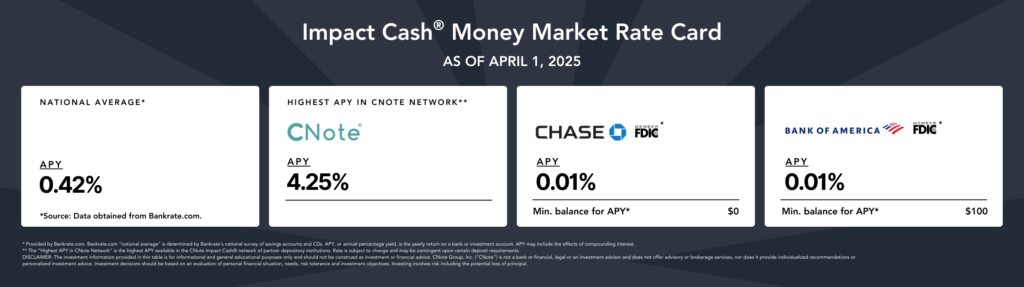

While rates at large institutions have remained low—as little as 0.01% APY—community banks and credit unions are offering a compelling alternative (source: Bankrate). Through CNote’s Impact Cash® platform*, corporate clients can access rates as high as 4.25%* APY in money market accounts, while maintaining full FDIC and NCUA insurance.

This isn’t about taking on more risk. It’s about making a strategic shift toward stability, resilience, and value—especially when the future is anything but predictable.

📊 Here’s how it compares*:

- Highest APY in CNote’s network: 4.25%

- National average: 0.42%

- Chase and Bank of America: 0.01%

This rate card uses rates from Bank Rate, as of April 1, 2025, and underscores how even conservative cash can do more—without sacrificing safety or control.

Community Banks: Built for Resilience

Community banks and credit unions are not only critical to local economies—they’ve also demonstrated strong performance through economic shifts. Their lending practices tend to be more conservative, their portfolios more localized, and their track records during times of stress speak for themselves.

For corporate finance leaders looking to reduce exposure to volatility while maximizing the value of idle cash, community banks represent a stable and mission-aligned solution.

With CNote, it’s easy to deploy cash across a diversified network of these institutions while receiving:

- Competitive APY

- Full federal insurance

- Quarterly impact reports

Rethinking Cash as a Strategic Asset

As interest rates rise and fall, many companies are exploring smarter ways to position their cash. If you’re looking for a deeper understanding of how community banks fit into that strategy—and how they compare to other options—we’ve put together a comprehensive, data-backed white paper just for you.

📄 Explore our latest research:

From Myths to Opportunities: Uncovering Value in the Community Banking Sector

This report takes a closer look at the common misconceptions about community banks and dives into:

- The real risks and returns of community financial institutions

- How community banks have performed through recent market shifts

- Why they offer a strategic advantage for companies looking to manage cash differently

- How deposits with these institutions can align with corporate values and impact goals

Whether you’re navigating a volatile rate environment or simply rethinking your approach to cash, this white paper provides a valuable lens into what’s possible—and profitable—when you look beyond the big banks.

* Rate Card Disclosurer: Rates are provided by Bankrate.com, as of April 1, 2025. Bankrate.com’s “national average” is determined by Bankrate’s national survey of savings accounts and CDs. APY, or annual percentage yield, is the yearly return on a bank or investment account. APY may include the effects of compounding interest. ** The “Highest APY in CNote Network” is the highest APY available in the CNote Impact Cash® network of partner depository institutions as of April 1, 2025. Rate is subject to change and may be contingent upon certain deposit eligibility and requirements.

*Impact Cash® Disclosure: Impact Cash deposits are insured by the FDIC or NCUA, subject to the terms and conditions of the Impact Cash agreements. CNote Group, Inc. (CNote) is not a bank, a credit union, or any other type of financial institution. CNote is not a registered investment advisor with the Securities and Exchange Commission (SEC) or a broker-dealer authorized by the Financial Industry Regulatory Authority (FINRA). CNote is not a legal, financial, accounting or tax advisor. CNote does not negotiate interest rates. Impact Cash deposits are not securities or investments. We encourage you to consult with a financial adviser or investment professional to determine whether or not the CNote platform makes sense for you.This information should not be relied upon as investment or financial advice. Any projected returns are illustrative, based on interest rates offered currently or in the past, which may be subject to change at any time, and may not reflect the ultimate rate of return. Past performance is no guarantee of future results, and future returns may vary.