-

Are Corporations Leaving Money on the Table by Overlooking Community Banks?

In today’s economic climate, uncertainty is a given. Interest rates are fluctuating, markets are shifting, and corporate finance teams are being asked to do more with less—while still preserving capital, ensuring liquidity, and managing risk. In times like these, the way companies manage their cash matters more than ever. Many corporations are reevaluating their treasury…

-

Why Geography Matters: Rethinking Where You Bank

When most people think about where to keep their money, they focus on interest rates, digital convenience, or brand familiarity. Rarely do we consider geography — the physical location of a bank or credit union — as an important factor in that decision. But geography plays a surprisingly powerful role in how your money is…

-

florrent and CNote: A Mission-Driven Partnership for Impactful Treasury Management

florrent is a minority-led, Massachusetts-based startup pioneering high-performance energy storage solutions. Their next-generation supercapacitors provide a cost-effective and sustainable alternative to traditional power quality and reliability technologies, ensuring firm power at every level of the grid. More than an energy innovator, florrent is committed to reshaping the clean energy economy to benefit all communities, building…

-

How Genesis Helped Shalom House Transform a Historic Property into Supportive Housing for People with Substance Use Disorder

In 2018, the closure of Serenity House, a long-running sober living facility in Portland, left a critical gap in housing and treatment resources for local individuals experiencing homelessness and substance use disorder. The historic property at 30 Mellen Street had been a beacon of hope, but, empty, it highlighted Portland’s pressing need for supportive housing…

-

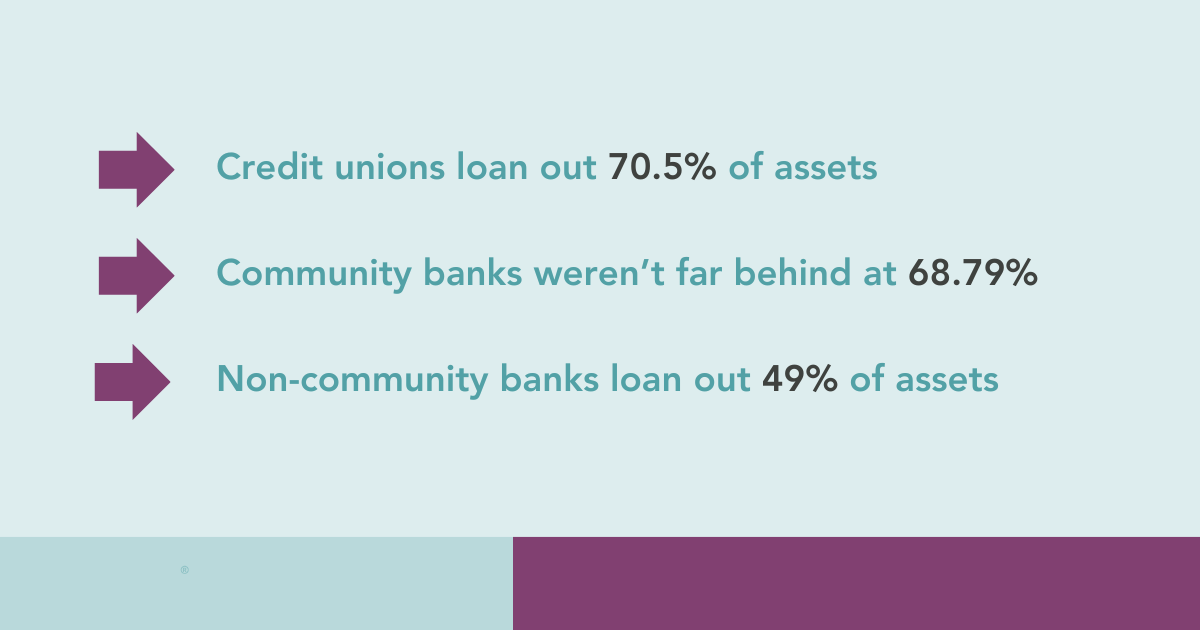

Where Your Money Actually Goes: The Hidden Power of Depositing in Community Banks

When you place funds in a bank, what happens next? Most people assume their money just sits there until they need it. But in reality, every deposit has the potential to power businesses, support families, and strengthen local economies—if it’s placed in the right hands. Community banks and credit unions are leading the way when…

-

Bridging Impact and Investment: Insights from 2024 Investor Engagement and Annual Reporting

Understanding what resonates with investors is essential to directing more mission-aligned capital to mission-driven depository institutions (DIs) making a difference in underserved communities. To deepen this understanding, CNote recently analyzed investor engagement across multiple channels to identify the impact themes that consistently drive interest and investment. There is a key opportunity to build on this…

-

How Long Does It Take for a Community to Recover After a Natural Disaster? The Answer May Surprise You

It can take years—sometimes even decades—for a community to fully recover after a natural disaster. While emergency aid and media attention often fade within weeks, research shows that long-term recovery efforts typically span six to ten years, with some communities still struggling decades later (Urban). The timeline depends on the severity of the disaster, the…

-

Why Values-Based Cash Management Matters

In today’s business environment, cash management is not just about maximizing returns and maintaining liquidity—it’s also about aligning financial strategies with organizational values. Values-based cash management is gaining momentum as more organizations realize the significant impact their financial decisions can have on the communities they serve. At the forefront of this movement are community banks…

-

Where Values Meet Finance: Prime Coalition’s Strategic Partnership with CNote in Action

Prime Coalition (Prime) is a nonprofit organization on a mission to unlock catalytic capital and change the future of climate finance. “We’ve been catalyzing climate solutions for over a decade, enabling innovation that holds the potential of mitigating gigaton-scale greenhouse gas emissions” says Prime. In 2023, Prime partnered with CNote to help achieve their…

-

6 Ways to Explore Impact Investing

Impact investing is gaining traction as more individuals seek ways to align their financial decisions with their values. Rather than focusing solely on financial returns, impact investing provides opportunities to support businesses, funds, and initiatives that drive positive social and environmental change. If you are exploring impact investing, understanding the landscape and available options can…

Blog

Where finance meets impact.