Category: Impact Investing

-

CNote Launches Promise Account

Today, CNote has officially launched The Promise Account, a cash solution that optimizes for impact and return, while being fully insured. You can learn more on the product page and read pre-launch coverage from Impact Alpha. CNote’s Promise Account Taps Power of Cash for Competitive Returns + Social Impact New insured cash solution shifts capital…

-

List of 2020 Institutional Impact Investing Conferences

We’ve rounded up some of the largest Impact Investing events around the United States for institutions and those in financial services that are interested in learning more about effecting change with their dollars. These events afford great opportunities to learn from and collaborate with like-minded investors in an inspiring setting. We hope to see you…

-

What You Need to Know About Social Investment

Social investment, also known as socially responsible investing, social investing, and impact investing, allows investors to align their values with investment strategies that positively impact social issues while generating a financial return. Social problems such as natural resource preservation, better education and healthcare, animal welfare, corporate responsibility, inequality, and climate change are attracting those that…

-

Positive and Negative Investment Screening Explained

If you have explored socially responsible investing (SRI), then you might also be familiar with the concept of investment screening. Socially responsible investing, a form of impact investing, is a strategy used to align investments with social goals. Investors understand that their money can produce positive outcomes in more than just a financial sense by…

-

Making an Impact: How to Invest in Community Development Financial Institutions (CDFIs)

Large banks and foundations have been investing in community development financial institutions (CDFIs) for decades. But until recently, investing in CDFIs was challenging and usually limited to all but experienced large banks, foundations, and some high-net-worth investors. Now technology platforms like CNote are allowing investors of all types to easily deploy capital across a diverse…

-

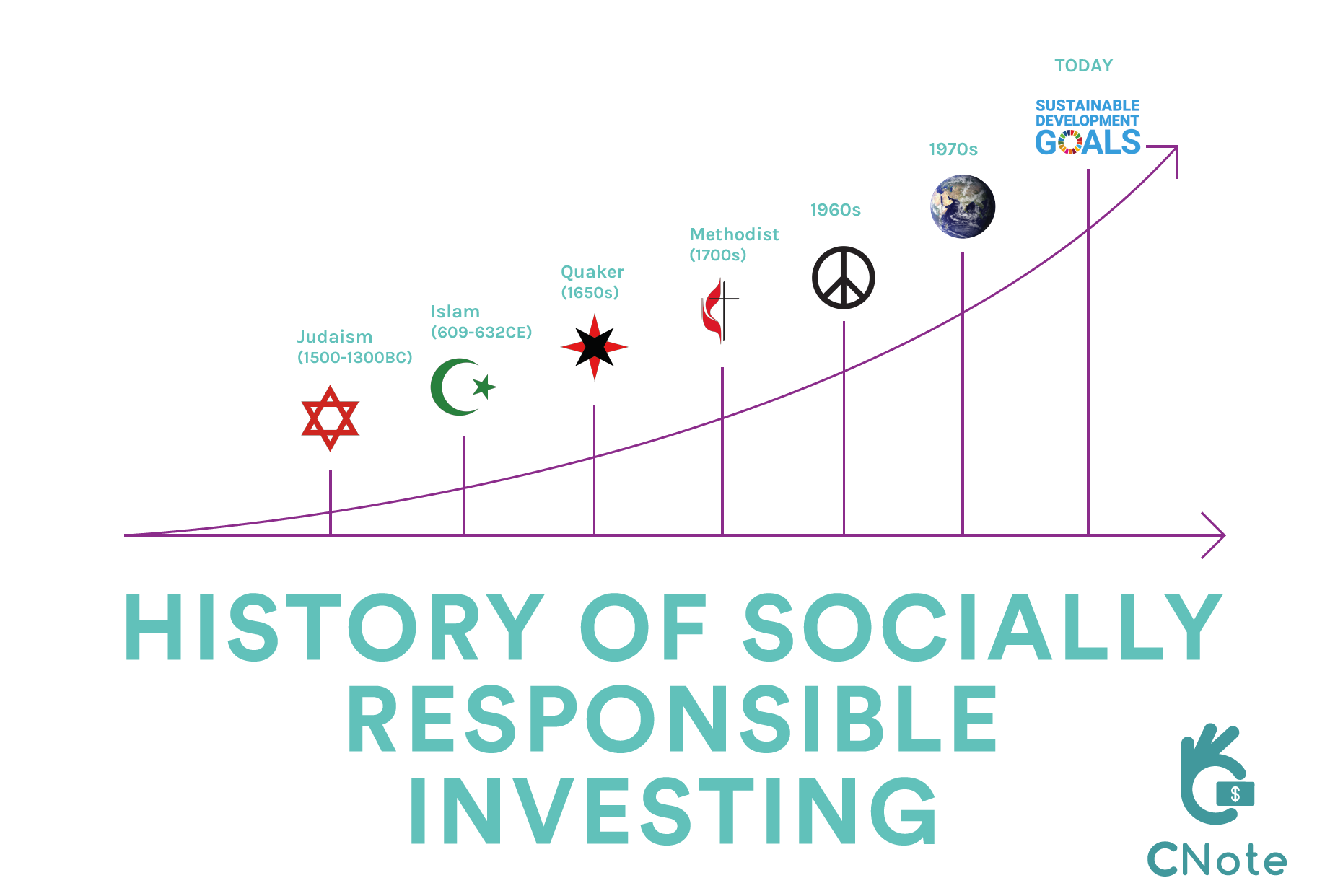

The History of Socially Responsible Investing

Many investors are choosing to align their portfolios with their personal values, using their investments to make a positive impact. While socially responsible investing might seem like a new phenomenon due to its rapidly growing popularity, its earliest origins trace as far back as the first books of the bible. The history of SRI The…

-

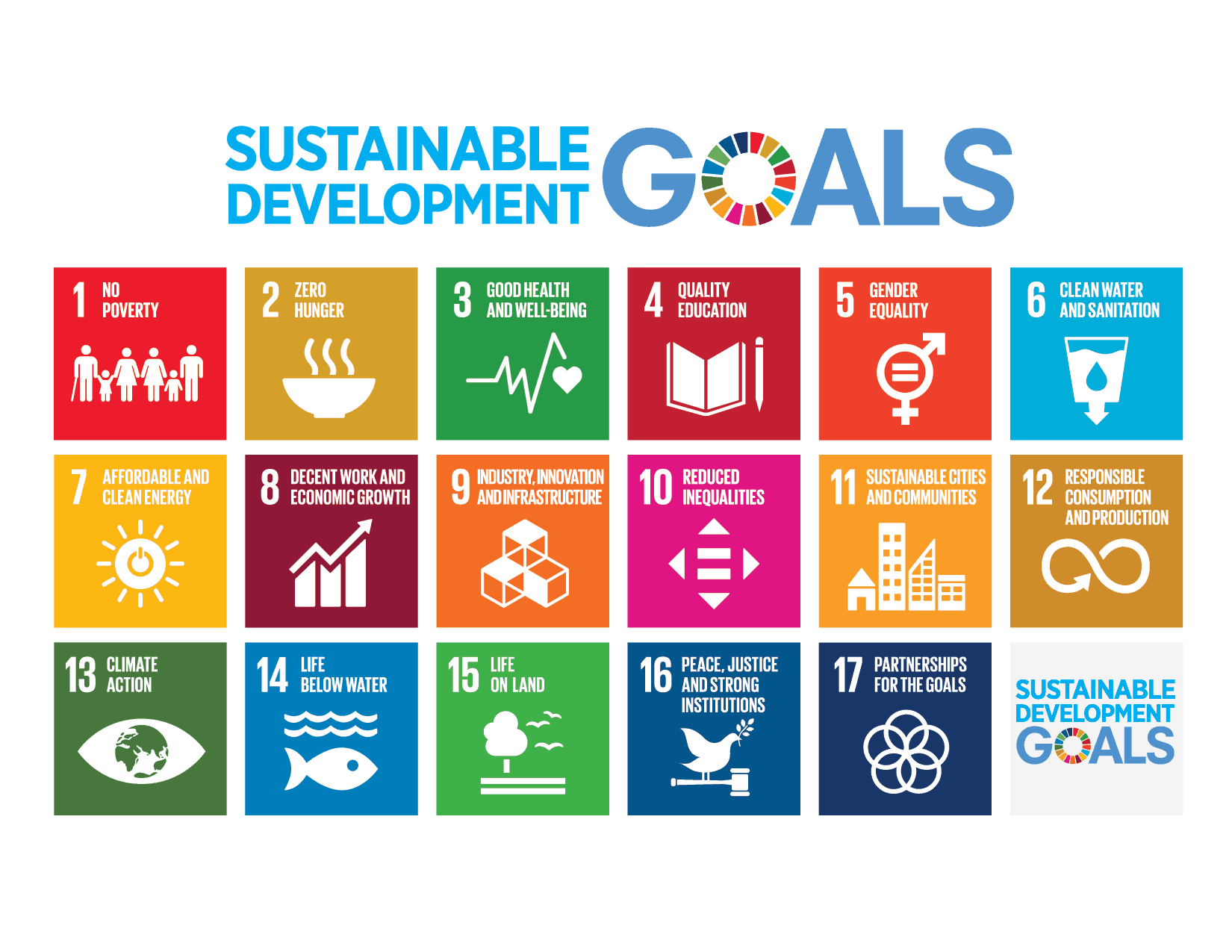

Impact Investing and the United Nations Sustainable Development Goals

Impact Investors are increasingly adopting the United Nations Sustainable Development Goals (SDGs) as their own. This can involve mapping investments to specific SDGs or even more thorough strategic alignment through the design of financial products specifically for their achievement. However, there is still a lack of awareness across the financial sector, particularly in the United…

-

What’s the Big Deal About Inequality And What Role Does the U.S. Federal Reserve Play?

Why Does Inequality Matter? The phenomenon of increasing wealth inequality has emerged as one of the major socio-political issues of our time. Whether you turn to TV stations, newspapers, or internet blogs to keep up to date with news and current events, there’s a good chance that you have already seen the topic come up…

-

Retail Impact Investing Options

What impact investing options are currently available to retail investors? What is impact investing and how can I participate? These are questions we often hear from individual investors looking to connect their money with meaning. According to the Global Impact Investing Networking (GIIN), impact investing refers to investments that are “…made into companies, organizations, and…

-

Doubling the Impact: The Benefits of Integrating Impact Investing with Donor-Advised Funds

The Growth of Donor Advised Funds When it comes to charitable donations, the increasing importance of Donor-Advised Funds (DAFs) is undeniable. In 2017, DAFs accounted for as much as 7% of total charitable giving and 10.2% of individual giving, rising from just 4.4% of individual giving as recently as 2010 Data comes from page 7…