When you place funds in a bank, what happens next?

Most people assume their money just sits there until they need it. But in reality, every deposit has the potential to power businesses, support families, and strengthen local economies—if it’s placed in the right hands.

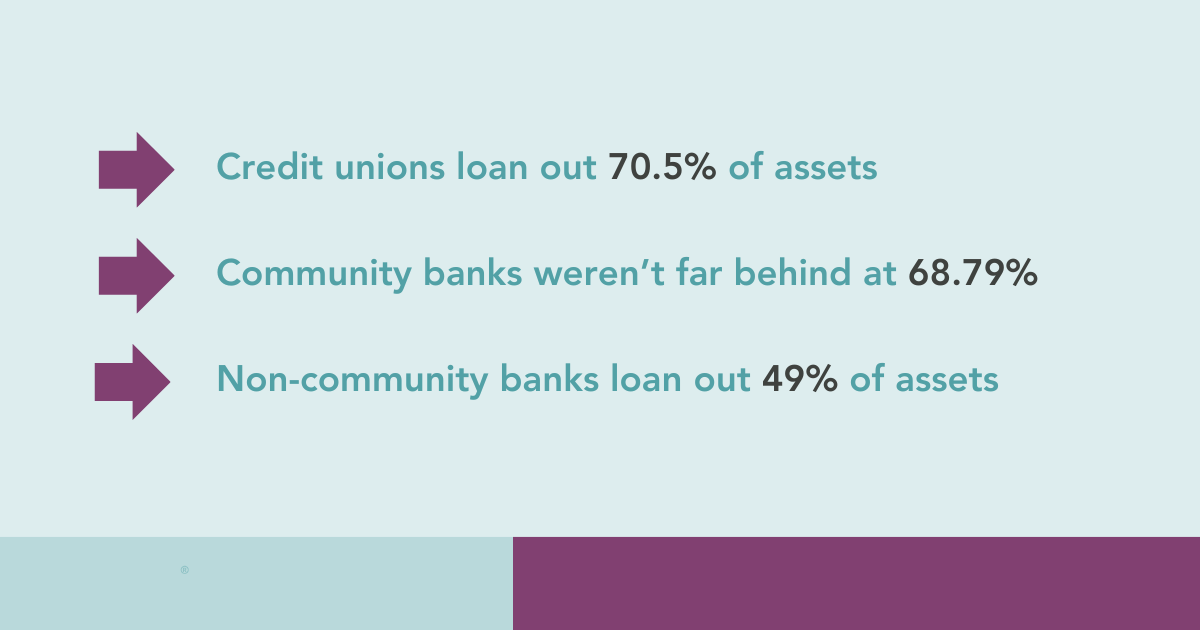

Community banks and credit unions are leading the way when it comes to putting capital to work. As of June 2024:

- Credit unions had loaned out 70.45% of their assets

- Community banks weren’t far behind at 68.79%

- Meanwhile, non-community banks averaged just 49%

This means that community-based financial institutions are channeling a far greater share of their capital into loans—supporting underrepresented borrowers, small businesses, and organizations driving grassroots change.

The Real Impact of Community Banks

Deposits placed in a credit union or community bank can create a ripple effect. Unlike traditional institutions that may prioritize other forms of asset allocation, community financial institutions focus on lending capital back into the very communities they serve.

That makes every dollar more productive, more impactful, and more meaningful.

When loans flow into underrepresented areas and entrepreneurs, they generate jobs, expand services, and help communities thrive. The lending activity reflects a deeper commitment to local growth and long-term economic resilience.

A New Way to Think About Cash Management

These lending numbers aren’t just impressive—they’re a signal. For individuals and institutions looking to align their financial decisions with meaningful outcomes, community financial institutions offer a compelling alternative.

Whether you’re managing corporate cash or seeking to amplify the impact of your reserves, understanding where your money goes—and what it enables—is essential.

Want to Dig Deeper?

CNote’s latest white paper, “From Myths to Opportunities: Uncovering Value in the Community Banking Sector,” breaks down the data, debunks the common misconceptions, and offers a data-driven case for why community banking matters more than ever.

Because when your money moves with purpose, it creates value far beyond financial returns.